When it comes to the world of secondary markets, there’s a lot of terminology that is used in everyday language that can naturally be confusing for newcomers. You might be hearing a lot of different terms and be left wondering what does that mean, and what implications does it have for me as an early employee, founder or investor? In this post, we’ll break down some of the basic terms used in secondary transactions so you can understand how it works and what to look out for.

Stay tuned for future posts in which we’ll explore specific aspects of some of the topics mentioned below in further details.

In alphabetical order:

Articles of Association

Also typically referred to as the Articles (similar to an LLC’s operating agreement or a corporation’s bylaws), this document essentially forms a contract between the shareholders and the company itself. Articles are drawn up or adopted at the time of incorporation (in most cases the model articles are adopted) but are capable of being amended at any time.

- the powers and duties of directors;

- the classes of shares, and the rights attached to them;

- the procedures for calling, holding and voting at board meetings and shareholder meetings;

- the process involved with issuing, allotting and transferring shares; and

- drag along and tag along rights – in the case of drag along rights, the majority shareholder(s) have the power to make the minority shareholder(s) sell their shares (in the context of an offer for the whole company). On the other hand, tag along rights allow minority shareholder(s) the right to have their shares purchased on the same terms as the majority shareholder(s).

Passion Capital released a template of the Articles of companies they invest in which you can find here (it’s a great way to act as a benchmark of the companies that you’re also interested in investing in).

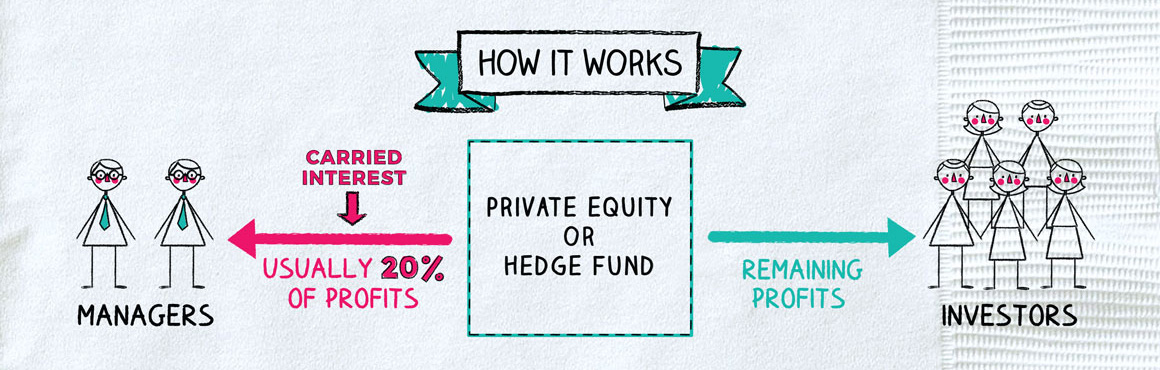

Carry/Carried Interest:

The cost of holding a position in an asset, and represents the percentage of profits from your investment that are paid to the fund on a successful exit. Carry is typically set at 20% of the overall profits after return of the initial investment capital to investors.

For example:

- you invest £10,000 into X Company

- X Company has a successful exit, and your initial capital is now worth £50,000

- the fund will receive 20% of the profit, which is 20% of £40,000 = £8,000

Pre and post-money valuation

Pre-money valuation is the value of a company before an investment is made. Meanwhile, the post money valuation takes into account any external investment that has been made. For example, if a company has a pre money valuation of £10 million and receives an investment of £5 million, its post money valuation would be £15 million.

You might be thinking well that’s obvious, but it actually has a bit more significance than showing that investors can do simple arithmetics. The difference between the pre-money valuation and the post-money valuation of a company is important because it ultimately determines the equity share that investors are entitled to after the financing round is over.

Right of first refusal (ROFR) and Right of first offer (ROFO)

The ROFR gives the holder of the right (the existing shareholders), the option to either accept or refuse an offer from a selling shareholder to purchase the shares on the same terms after the selling shareholder has received a third party offer. On the other hand, the ROFO allows the existing shareholders to make an offer for the shares that are to be sold. The seller can then accept or refuse the offer. However, if the offer is refused, the seller cannot accept an offer from a third party on the same or less favourable terms.

Share Purchase Agreement (SPA)

Also known as a Sale and Purchase Agreement, the SPA is a standard document that sets out the terms and conditions in relation to your acquisition of the shares, and establishes the rights and obligations of both the buyer and the seller. Some of the key aspects that the SPA will include are:

- what is being sold (the class and number of shares);

- the purchase price;

- conditions that need to be satisfied before the sale (known as conditions precedent);

- warranties and indemnities; and

- the completion provisions (the actions that need to be taken to ensure the deal is completed.)

Transfer rights

Whilst this one isn’t a specific term that you need to know, it’s an important consideration that should be had when you’re looking to sell or purchase shares in a private company.

The Articles and the shareholders agreement (if there is one) often provide very detailed rules as to whether you are allowed to transfer your shares, to who, and if so, equally detailed rules about the procedure that should be followed when transferring the shares. Whilst navigating through the maze that is the transfer provisions can be confusing, it’s important to review these carefully before setting out to sell or purchase shares in a private company.

Warranties

Warranties are statements in a contract relating to the existence or accuracy of a fact, or the condition, quality, quantity, or nature of a good, in this case the shares.

Whilst not specific to secondaries, warranties form an important part of the documentation used to effect the secondary transaction and are used as a mechanism to protect the purchaser.

In a secondary transaction, some of the warranties that you can typically expect to see (amongst other things) are mainly in relation to the shares rather than the state of the company to which the shares are held, and include statements like:

- the seller is the legal and beneficial owner of the shares;

- the shares are fully paid for;

- none of the shares are subject to an encumbrance;

These statements serve the purpose of:

- providing the buyer with a a claim for breach of warranty if the statements made prove to be incorrect; and

- encourage the seller to disclose known problems to the buyer.

We hope you find our glossary useful and that it helps boost your confidence whether looking to sell, purchase or simply monitor shares in private companies.

If there are any other secondary market terms that you’ve come across and have never heard of before? Let us know!